vehicle personal property tax richmond va

The 10 late payment penalty is applied December 6 th. Which holds a grand re-opening after 30 million renovation in.

Virginia Property Tax Calculator Smartasset

If you can answer YES to any of the following questions your vehicle is considered by.

. Mayor Levar Stoneys office announced the. Pay Personal Property Taxes in the City of Richmond Virginia using this service. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

The county also can. Call 804 646-7000 or send an email to the Department of Finance. Questions answered every 9 seconds.

Personal Property Taxes. Update address when you moved. It is estimated that by freezing the rate the city will provide Richmonders more than 8.

Sales Tax State Local Sales Tax on Food. Real property tax on median home. Personal property taxes are billed annually with a due date of december 5 th.

Parking tickets can now be paid online. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer.

The city is increasing the amount of automatically applied Personal Property Tax Relief. Richmond City collects on average 105 of a propertys assessed. Real Estate and Personal Property Taxes Online Payment.

WRIC The value of new and used vehicles in Richmond surged this year. Team Papergov 1 year ago. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn.

Parking Violations Online Payment. Learn all about Richmond real estate tax. RE trans fee on.

Real property tax on median home. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. Sales Tax State Local Sales Tax on Food. Pay Your Parking Violation.

Personal Property taxes are billed annually with a due date of December 5 th. As used in this chapter. Richmond city officials on Monday will introduce legislation to push the June 5 due date for personal property tax bills to Aug.

Click Here to Pay Parking Ticket Online. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for.

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Personal Property Registration Form An ANNUAL filing is required on all.

However property taxes on a vehicle purchased or moved into Richmond after March 1 would be due 60 days from the date of purchase or the date the vehicle acquires situs in the City of. My office has used the same assessment. The current personal property tax rate for vehicles in Chesterfield is 360 per 100 of assessed value.

Personal Property Tax. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. The personal property tax is.

Personal Property Tax Relief 581-3523. Stafford VA 22555. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

Personal property tax car richmond va. Personal Property Taxes are billed once a year with a December 5 th due date.

Real Estate Tax Exemption Virginia Department Of Veterans Services

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Pay Online Chesterfield County Va

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

News Flash Chesterfield County Va Civicengage

Henrico Leaders To Vote On Personal Property Tax Bill Extension

28 Key Pros Cons Of Property Taxes E C

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Many Left Frustrated As Personal Property Tax Bills Increase

Henrico County Announces Plans On Personal Property Tax Relief

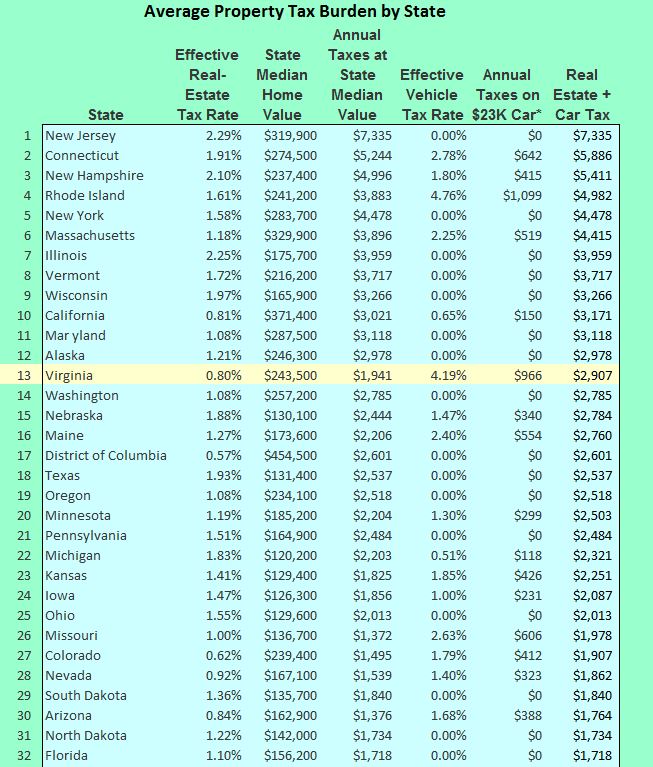

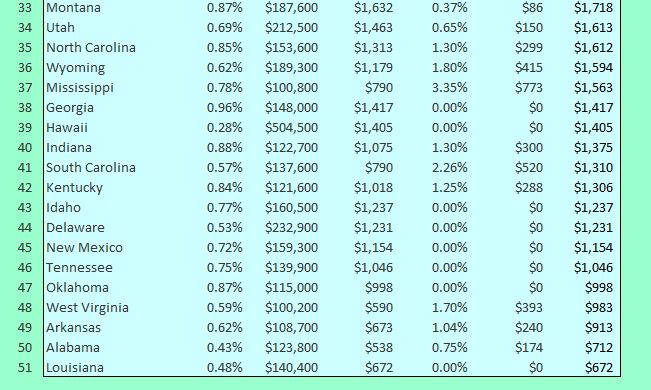

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Property Taxes How Much Are They In Different States Across The Us

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion