how to check unemployment tax refund on turbotax

DOR has reviewed all 2020 individual income tax returns filed on or before April 9 that included unemployment income. So in theory if you e-file your tax return on the starting day of January 27 th 2022 you should receive your tax refund by February 16 th or a paper check between March 9th and March 23rd.

My Tax Return Is So Low This Year When It S Been Generally Bigger Other Years And I Can T Figure Out Why I Worked Full Time All Year I Ve Looked Over My 1040

Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay.

. You report your unemployment compensation on schedule 1 of your federal tax return in the additional income section. Federal income tax is withheld from unemployment benefits at a flat rate of 10. The deduction up to 10200 will be on line 8 with the notation UEC.

I filed early February and received my original refund March 1st. Once you have e-filed your tax return you can check your status using the IRS Wheres My Refund. Well help you track.

TurboTax cannot track or predict when it will be sent. When its time to file your taxes you will receive Form 1099-G which will show the amount of unemployment income you received. You are now entitled to exclude the first 10200 of federal unemployment income from paying any taxes.

Tax Refund Processing. When you finish entering this information click on the Submit button on the page to see the status of your refund. I check my transcript everyday.

Lets track your tax refund. Step 3Go to the Wheres My Refund page on the IRS website When you access the Wheres My Refund tool you will see three separate boxes to enter your filing status refund amount and Social Security number. If you believe you received a refund in error please contact us at 887-6367 before taking any action.

Top suggested level 1 these-things-happen 2m Search UCE adjustment. I will keep checking 0 Reply Hal_Al. Unless your state posts a different procedure then probably you will have to use Turbotax to prepare an amended federal and state return and only file the state return by mail.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive. If you did not receive a form before this due date check with your state agencyyou may have to log in your states unemployment portal to obtain it.

Up to 3 weeks. The gross amount of unemployment from your 1099-G will be on line 7. Look at Schedule 1.

In the Refund Date field enter the deposit date. Up to 3 months. Return Received Notice within 24 48 hours after e-file.

In the For Period Beginning field enter the first day of the pay period that the. 1 level 2 theerduck Op 2m Thank you 2 level 1 Vodkaakisses 2m I went to add state at. Heres an article you can look up your state.

1 Reply Chelseah050618 Level 1 June 5 2021 719 PM Thank you I looked and it doesnt look like anything has been updated on turbos and yet either. If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted by. Unemployment and Taxes Explained TurboTax Tax Tip Video If you are filing Form 1040 or 1040-SR enter the total of lines 1 through 7 of Form 1040 or 1040-SR.

4 Steps From E File To Your Tax Refund The Turbotax Blog Terms and conditions may vary and are subject to change without notice. While the total benefits are reported in Box 1 of the Form 1099-G you will only need to report a partial amount on your Schedule 1 of the Form 1040 tax return if you qualify for the new tax break. Lets track your tax refund.

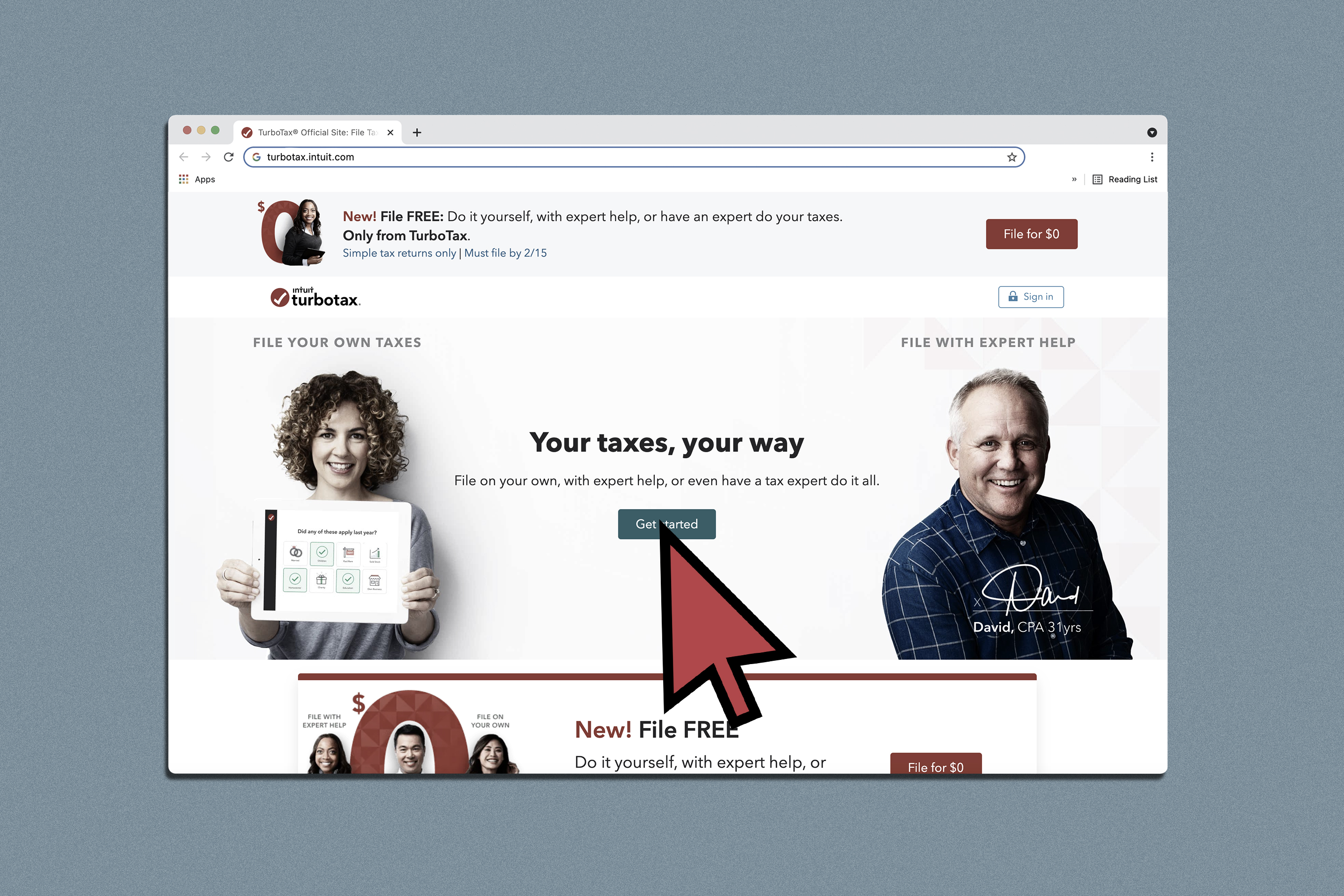

The unemployment tax break given to taxpayers who received unemployment compensation with a modified adjusted income of less than 150000 is eligible for up to 10200 tax break on this income earned. You can easily check your e-file status online with TurboTax. Accepted youll be able to start tracking your refund.

Check the e-file status of your federal tax refund and get the latest information on your federal tax return. Enter the amount from Schedule 1 lines 1 through 6. Select the name of the vendor who submitted the refund check.

They should walk you through the eligibility and calculation. The unemployment tax break given to taxpayers who received unemployment compensation with a modified adjusted income of less than 150000 is. The IRS tax refund schedule dates according to the IRS are 21 days for e-filed tax returns and 6 to 8 weeks for paper returns.

You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits. Log In Sign Up Sort by. Adjustments have been made and refunds have been issued for returns that we determined were eligible for a refund.

Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities. TurboTax cannot track or predict when it will be sent. Start checking status 24 48 hours after e-file.

When you file your federal income tax return on TurboTax youll get these automatically handled if you received unemployment compensation and. If you are filing Form 1040-NR enter the total of lines 1a 1b and lines 2 through 7. After the IRS accepts your return it typically takes about 21 days to get.

E-filing is the fastest way to file your taxes and get your refund. Form 1099-G will also show any federal taxes you had taken out of your unemployment pay. IRS e-file statuses Once you prepare and submit your return your e-file status is pending.

On my transcript I am scheduled to have my unemployment refund deposited this week to the same bank account. Heres how to enter a payroll liability check. Once you receive confirmation that your federal return has been.

If your mailing address is 1234 Main Street the numbers are 1234. You will need your Social security number or ITIN your filing status and your exact refund amount. Turbotax taxtools wheres my refund.

When its time to file have your tax refund direct deposited with credit karma money to. How long it normally takes to receive a refund. Yes got my federal refund direct deposited on 224 and the unemployment refund deposited on 63.

12 hours agoCredit Karma Tax vs TurboTax. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. However many states already dont tax unemployment compensation so you may not have to do anything depending on your state.

This means its on its way to the.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

How Do I File My Taxes Using Turbotax Online Turbotax Support Video Youtube

Tax Return For Covid 8 Ways Your Tax Return Might Look Different Because Of Covid Glamour

How To Check Your Income Tax Refund Status 2022 Turbotax Canada Tips

How To File Taxes For Free Turbotax 2022 Free File Change Money

Everything You Need To Know About The New Unemployment Benefits And Tax Relief Youtube

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

Unemployment Center The Turbotax Blog

Unemployment Benefits And Child Tax Credit H R Block

6 Tips To Get A Head Start On Your 2020 Tax Return Forbes Advisor

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Helpful Information For Filing Taxes As The Deadline Approaches Canadian Immigrant

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How Does A Furlough Or Lay Off Impact Your Taxes Turbotax Tax Tip Video Youtube

I Finished Filing My Taxes What Now 2022 Turbotax Canada Tips

December S Stimulus Bill Every Major Benefit You Get Including A Second Check For 600 Filing Taxes Online Taxes Tax Refund